Insights

Why “Standard” Contracts Often Hurt Small Businesses

Small businesses work hard to control costs. That is why many owners grab a standard contract they find online and hope it will do the job. The problem is simple. A contract that looks fine on the surface often fails when something goes wrong. At that point the business discovers that the

DAO – The Most Expensive Entity Structure Known to Man

I imagine only a handful of attorneys out there took a deep dive into COALA’s Model Law for DAOs (ML). For those that don’t have

Meditate Before You Mediate

Breath in. Mediation – what is it? In its purest form, it’s an alternative dispute resolution mechanism designed to resolve adversarial disputes. It’s also mandatory

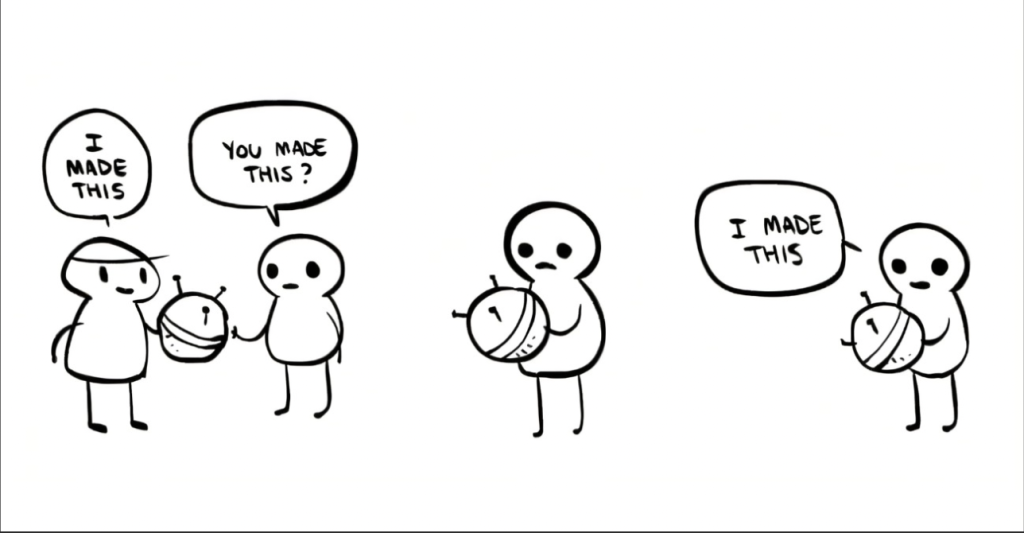

Why Hire A Trademark Attorney? (A Simple Click Won’t Protect Your IP)

We made this meme. Just kidding. We don’t know who made this. That’s why Trademarks are important. Between Doordash, Amazon, and other online platforms, we’ve

Life is Like a Box of…Board Games?

That’s how the saying goes, right? Maybe not, but I’m the odd bird who doesn’t particularly care for chocolates. I do, however, love a good

SC Real Estate Agents: 3 tips to make sure your clients actually close

If you are a real estate agent, you’ve been there. After months of searching, you finally find a home for your clients that checks all

Don’t Wait To Mediate: Why Early Mediation May Be Your Dominant Strategy

We litigate cases and are confident in our ability to effectively advocate on your behalf. So why write a blog post encouraging you to consider