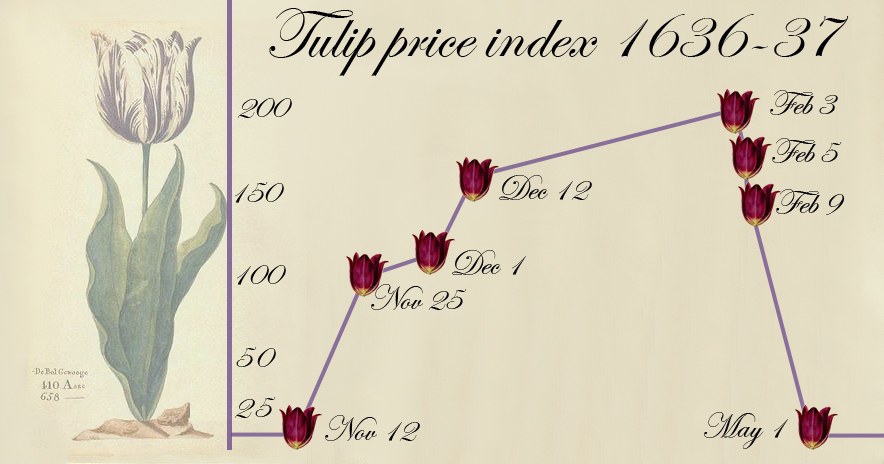

The media hype surrounding cryptocurrencies this year has done little else than ring the bubble bell. A reincarnation of the Dutch Tulipmania! Irrational exuberance! Tech Wreck Part 2! Peek behind the curtain, however, and you’ll notice that much of the hysteria is being propagated by pin heads and stuff-shirts on CNBC with little understanding of this new technology. Bitcoin may well be worthless tomorrow. Blockchain is about to get all up in your business, and it don’t matter what industry you’re in–you can’t hide.

So what’s a business owner to do? First look at everything in your industry that relies upon somebody keeping track of stuff or maintaining an historical record. (Yeah, it really is that broad.) Second, ask who keeps this record, why do they keep it, and how do they get paid? Third, acknowledge that this middle-man is about to get punched in the face, and if it’s something you get paid for, find other ways to make money.

Put another way, Blockchain technology is about to take dis-intermediation to the next level. This will lower transactions costs and shine a lot of daylight on pricing. Take the municipal bond market for example. For years the sale of odd-lot munis has been a really opaque market. No-one knows the going rate, and the spreads between bid and ask have been very healthy, enabling traders to catch a big fee just for getting in the way of the deal. But if you flip this around to a distributed ledger using a blockchain technology, now every participant in the market has a copy of the master ledger. I won’t necessarily know who you are, but I will know how much you paid for your bonds. In theory, I’ll also be able to see the spreads in real time without having to go through a trading desk. Bondholders and municipalities will gain lower transactions costs and higher liquidity, but traders lose.

So what does that have to do with us going long on Bitcoin and cryptocurrencies? A few months ago, Campbell Teague started accepting Bitcoin and Ethereum as payment for our invoices. We also have begun a deep dive into smart contracts and the code platforms that support them. Lawyers are by definition, a transaction cost, and law firms have two choices. You can be either a sail or a sea anchor. One propels the boat forward, the other drags it down to Davy Jones Locker. We want to be on the front line of this new technology and use it to help our clients get things done better, faster, and cheaper–not just in law, but in every aspect of business.

Bitcoin could (and is likely to) crash any day, but there is a big difference between the signal and the noise. Pay attention to Blockchain, and welcome to the 21st Century. #SuperCycle